Last fall, Ms. F. was a restrained, front passenger in her friend’s vehicle (“host vehicle”) traveling east on Salerno Road when her friend ran a red light causing a violent crash that turned Ms. F’s world upside down.

Upon impact, the airbags deployed and the vehicle (as shown below) was ultimately deemed a total loss.

At the time of this crash, Ms. F. did not own a vehicle; she also did not reside with any family/relatives – therefore, she was afforded Personal Injury Protection (PIP) automobile insurance benefits through the host vehicle/driver’s insurance company.

Ms. F. contacted Murray Guari Trial Attorneys, PL, met with Attorney Scott Murray and requested his representation for her claim.

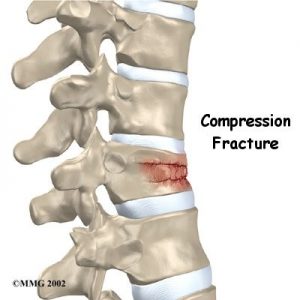

As a result of this crash, Ms. F. injured her neck with radiating symptoms and her back, including a compression fracture of her back at L1 (illustrated below), with radiating symptoms into her lower extremity for which she underwent lumbar spine surgery.

Fortunately, Ms. F.’s friend carried Bodily Injury (BI) automobile insurance coverage and both, her friend and his insurance company accepted complete responsibility for this crash. (Ms. F. did not want her friend to become personally responsible for her personal injury damages). A key factor to establish the extensive damages Ms. F. sustained was her friend’s willingness to testify truthfully about his observations of Ms. F.’s pain and suffering from the crash.

With the diligent work of the Murray Guari Trial Attorneys PL, Attorney Scott Murray resolved Ms. F.’s case in less than a year for the total available Bodily Injury (BI) policy limits of $250,000.

This case is a reminder of the importance of driving safely and obeying traffic signals. Also it is most important to have as much automotive insurance coverage as you can afford.