Our client, a driver for a food delivery service, had her right-of-way unexpectedly violated when an individual exited a shopping plaza, crossed three lanes of oncoming traffic, to try to be able to make a U-Turn. Unfortunately, because the at-fault/Defendant driver cut in front of her so rapidly, there was nothing that she could have done to avoid the front of her vehicle striking the rear side of the other vehicle. The forceful impact deployed the airbags in our client’s vehicle, which was declared a total loss.

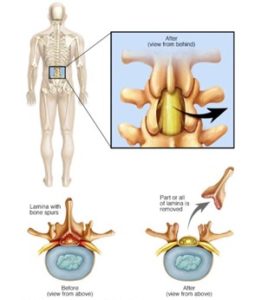

From the scene of the crash, our client went to the emergency room with head, neck, and low back injuries. After conservative treatment of chiropractic care, physical therapy, and injection therapy to her low back, our client underwent a low back surgery – including a laminectomy as illustrated above – with a board-certified orthopedic spine surgeon. Thankfully, our client’s treatment was successful, and her symptoms were alleviated.

After our client completed medical treatment, our firm demanded that the Bodily Injury (BI) policy limits be paid. The at-fault/Defendant driver’s automobile insurance carrier – which was not acting as a “good neighbor” – denied liability for the crash based on its insured’s statements of how the crash occurred. In turn, the team at Murray Guari Trial Attorneys was forced to file a lawsuit on behalf of our client in Palm Beach County. Mr. Hedrick deposed the at-fault driver and exposed the weaknesses in his testimony about the crash. After extensive discovery in litigation, the firm resolved our client’s claim for all available Bodily Injury policy limits at a Court Ordered Mediation.

Unfortunately, our client did not carry Uninsured / Underinsured (UM/UIM) Motorist coverage at the time of this incident meaning her recovery was limited only to the at-fault/Defendant driver’s automobile insurance policy limits – which did not represent the full extent of her damages.

This is a reminder that you should never reject UM/UIM coverage – buy as much as you can afford to protect yourself and your loved ones – and always “stack” the coverage!