Protect Your Family!

DON’T Reject Uninsured/Underinsured Motor Vehicle (UM/UIM) Coverage!

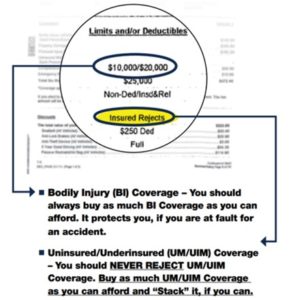

Below is a typical, auto insurance Declaration Sheet. A “Dec Sheet” is a summary of your personal auto policy and will include things like your insurer’s name, policy holder’s name, policy number, policy periods, listed vehicles, types of coverage, and premiums for the listed vehicles.

Your Auto Insurance Policy SHOULD NEVER look like this:

- Bodily Injury (BI) Coverage – You should always buy as much BI Coverage as you can afford. It protects you, if you are at fault for an accident.

- Uninsured/Underinsured (UM/UIM) Coverage – You should NEVER REJECT UM/UIM Coverage. Buy as much UM/UIM Coverage as you can afford and “Stack” it, if you can.

If you or a loved one is involved in a motor vehicle crash, please contact us immediately to preserve your rights!

UM/UIM Coverage “Stacked or Unstacked”

You Must Have It!

Uninsured/Underinsured Motorist Coverage (UM/UIM) is not mandatory, but provides protection to you, resident relatives, and passengers in your vehicle, if involved in an accident with someone who has no liability coverage or not enough coverage to cover your damages. Simply stated, your insurance company “stands in the shoes” of the at-fault driver or owner.

UM/UIM Coverage comes in two forms – “Stacked” or “Unstacked.” “Stacked” multiplies your limits for this coverage by the number of cars you are insuring. For example, if you have two cars in your household and choose “Stacked” coverage, the UM benefit amount is multiplied by two. Although this increases your premium, the UM benefits double, thereby providing you with added personal protection.

“Stacking” also allows you to broaden UM/UIM insurance coverage under certain circumstances. If you are getting a new policy, or are about to renew your policy, remember to ask about “Stacked” UM coverage!

If you have questions regarding your insurance policy, or are unsure about your auto insurance coverages, contact us at 561-366-9099.