Firm Stresses the Importance of Buying Uninsured/Underinsured (UM/UIM) Auto Insurance

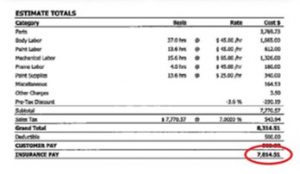

We had the privilege of representing Captain “L” for injuries she sustained as a result of a 2017 crash when a negligent driver forcefully rear-ended her vehicle causing $7,814.51 in property damage. Below are photographs of the accident scene – including our client’s vehicle.

Our client Captain “L” is a 32 year-old retired, Honorably Discharged, decorated veteran of the U.S. Army who now, proudly works as a Physician’s Assistant (P.A.) in private practice. In 2018, she underwent an anterior, C5-6 artificial disc replacement surgery to fix a cervical disc herniation with right upper extremity radiculopathy (numbness and tingling in her right, DOMINANT hand) from this heavy, rear-end collision.

Here is a photograph of Captain “L’s” neck post-surgery.

Prior to her surgery, Captain “L’s” right hand symptoms of numbness and tingling greatly affected her own ability to work as P.A. because her main job responsibility as a P.A. was “closing” orthopedists’ surgeries – that is irrigating and suturing.. Prior to this crash, Captain “L” took great pride “closing” surgeries. Captain “L” worked her whole life to get to where she was prior to this crash. Now, since her own successful surgery, she has regained her right hand dexterity and now enjoys the satisfaction of doing what she loves – helping people in the operating room.

Thankfully, the at-fault driver’s insurance company realized the risk to its insured driver and tendered/ paid the negligent driver’s auto policy limits of $250,000 to Murray Guari Trial Attorneys on behalf of Captain “L.” However, our client’s case had much more value given Captain “L” injuries, medical treatment, permanent injury, wage loss, pain and suffering, and loss of capacity to enjoy life.

Unfortunately, Captain “L” did not have Uninsured/Underinsured Motorist (UM/UIM) auto coverage in effect at the time of this accident; so, there was no other recourse to fairly compensate her for her damages. (UM coverage contractually and legally “stands in the shoes” of the negligent driver allowing the injured party to make a UM claim against their own insurance company.) UM insurance coverage is a must have.

It is very important to purchase Uninsured/Underinsured Motorist (UM/UIM) automobile insurance coverage. We urge you to buy as much UM/UIM insurance coverage as you can afford!