Our 69-year-old client’s car was forcefully rear-ended in April of 2016, by a young woman who was operating her dad’s truck that was insured by State Farm Mutual Automobile Insurance Company.

Our client’s car sustained over $8,600 in property damage, as shown below:

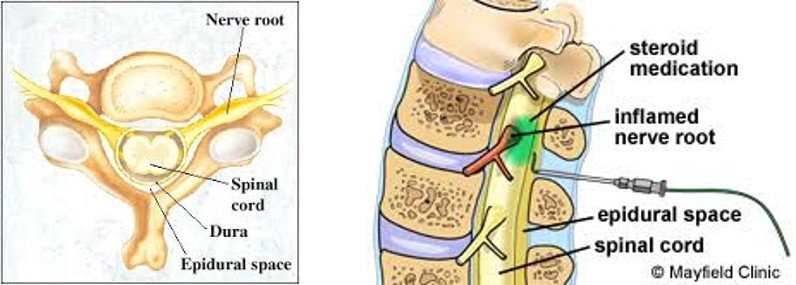

That same day, our client was taken to the hospital in St. Lucie County –- with neck pain, headaches, and left upper extremity radiculopathy. Because the problems did not go away, she followed up with her family doctor and an orthopedic doctor who sent her for Physical Therapy (PT) and for a cervical (neck) MRI. The MRI demonstrated herniations at two (2) levels of her cervical spine C5-6 and C6-7. Although PT helped, it did not fully resolve her numbness, tingling, and shooting pain down the back of her left arm. With continued symptoms, her orthopedist administered a cervical epidural steroid injection at C6-7 which gave her significant relief; the procedure is depicted below:

A Pre-suit/Pre-litigation Demand was sent by this firm to State Farm to seek compensation for our client’s injuries and pain and suffering. State Farm’s first offer did not even cover half of our client’s medical bills. Therefore, our only choice was to file a lawsuit against State Farm’s insureds to protect our client’s rights.

This process included filing a lawsuit, preparing and responding to written discovery, taking depositions of State Farm’s insureds, State Farm’s lawyers taking our client’s deposition, our client having to submit to a Compulsory Medical Examination (CME) by a doctor hired by State Farm, our firm taking depositions of property damage estimators of the damaged vehicles, our firm taking the discovery deposition of State Farm’s expert doctor witness, our firm’s attorneys attending multiple hearings, and ultimately the parties attending a confidential Mediation.

State Farm’s doctor – to whom State Farm paid more than $424,000 last year alone to do these defense examinations – said that if our client was injured, it was just a sprain / strain. His opinion did not make any common sense in light of our client’s MRI film shown below, as well as her medical symptoms and history:

Our client’s treating doctor/orthopedist said that, of course, her 69-year-old spine would have age related changes; however, with a spine as shown above, she was susceptible to injury given the fierce, rear-end impact. The radicular symptoms were caused by this crash, especially because she had never had prior complaints. Her doctor further stated that the herniations shown above were – more than likely than not – caused by the crash.

The case settled at Court ordered Mediation – a year and a half after the crash!

This is a classic example of how State Farm is handling legitimately hurt individuals’ claims.

State Farm’s deny, delay, and defend tactics simply wore down our client, but she held on until Mediation where our firm helped her obtain a just result.

Ultimately, State Farm did not act fairly towards our client until Mediation – after our firm had advanced over $7,000 in cost money to get to Mediation.

From all the TV advertising that State Farm pays for – especially during professional sporting events – State Farm would have the American public believe that it is merely a beloved American insurance company. The reality is, it has an obligation to make a profit for its shareholders sometimes at the expense of victims.

State Farm has been unfairly aggressive in its claims handling over the last several years. It knows that it costs claimants and their attorneys’ money to pursue claims; therefore, clients and their law firms need to have a strong resolve to fight back!