Guest Columnist – Gina Grandinette of Grandinette Law P.A.

“Why do I need an Estate Plan, I don’t have an estate?” For most adults, that is not true.  Do you own a car, a house, a boat, a rental piece of property? Do you have a bank account? Yes, all of these and more are a part of your estate, and they need to be protected! It is vitally important that you protect your assets, your children’s assets, and your elderly parents’ assets. “Why do I need an Estate Plan when I turn 18?” In the United States the age of majority is 18 in most states. With that being said, when your child leaves for college or empties the nest you no longer have the right to make financial or medical decisions for that person or have a right to see that information. But with proper documents, all of this can be made very simple!

Do you own a car, a house, a boat, a rental piece of property? Do you have a bank account? Yes, all of these and more are a part of your estate, and they need to be protected! It is vitally important that you protect your assets, your children’s assets, and your elderly parents’ assets. “Why do I need an Estate Plan when I turn 18?” In the United States the age of majority is 18 in most states. With that being said, when your child leaves for college or empties the nest you no longer have the right to make financial or medical decisions for that person or have a right to see that information. But with proper documents, all of this can be made very simple!

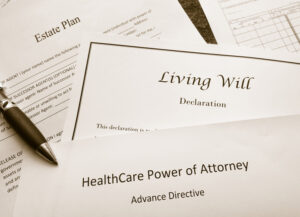

An Estate Plan is more than just a Will or a Trust. A thorough Estate Plan encompasses your healthcare surrogate or Healthcare Power of Attorney. This document allows a person of your choosing to make healthcare decisions if you cannot make your own. It should contain the HIPAA authorization (Health Insurance Portability and Accountability Act of 1996) which protects a patient’s privacy. This gives medical practitioners the permission to share information with those named on your document. Your Estate Plan should include a Living Will, otherwise called an Advance Directive, stating your wishes for end-of-life medical care, if you are unable to communicate your decisions. These two healthcare documents are lifetime documents, which no longer work after someone passes. Additionally, the next lifetime document you should have is a Durable Power of Attorney or a Financial Power of Attorney, which gives someone appointed the power to handle your financial decisions, sign your financial documents, and access your financial information. Lastly, there are primarily two options for after passing, a Will or a Trust. A Will does not avoid the probate process (court intervention when someone passes) but does guide the court on your wishes. A Trust does avoid probate, but only if it is funded correctly!

Elder Law Planning may also be a part of your Plan. We can help to navigate through the complexities of Medicaid eligibility and Elder Law affairs. The application process is time-consuming and best left to those familiar with your state’s requirements. Remember, Medicaid is not just for the indigent. Elder Law planning can help protect a person’s finances, their home, their resources from being spent down on care. At Grandinette Law, we can develop a plan that works for both you and your parents. In my practice, we guide clients through the planning process to make sure you have complete documents and a plan for the future. Part of loving and protecting your family is planning for events that may be different from those you had imagined. My practice includes Elder Law Planning and Estate Planning. If you need help you can call us at (561) 623-5317. Grandinette Law P.A.